Looking for the First Bank sort code? The unique identification number for each First Bank branch is crucial for conducting transactions smoothly. Ensuring accuracy is key! Let’s delve into the significance and how you can easily locate the sort code for your specific branch. Simplifying banking procedures starts with understanding the essentials. Let’s navigate the world of sort codes together for a seamless banking experience.

Exploring First Bank Sort Code: Everything You Need to Know

Welcome to our detailed guide on First Bank Sort Codes! If you have ever wondered what these codes are all about and how they impact your banking transactions, you’ve come to the right place. In this article, we’ll delve into the world of First Bank Sort Codes, explaining what they are, how they work, and why they are essential for seamless financial transactions.

What is a First Bank Sort Code?

A First Bank Sort Code is a unique identification number assigned to each branch of First Bank in Nigeria. It consists of nine digits and helps in routing funds accurately during electronic transactions such as transfers, payments, and withdrawals. Think of it as a digital address for your bank branch, ensuring that your money reaches the right destination swiftly and securely.

Understanding the Structure of a First Bank Sort Code

Each First Bank Sort Code is structured in a specific way to provide detailed information about the branch it represents. The nine digits are divided into three parts:

1. The first three digits:

The first three digits of a First Bank Sort Code represent the bank’s clearing system number. This indicates that the branch is part of First Bank and ensures that transactions are processed within the bank’s network efficiently.

2. The next two digits:

The next two digits of the Sort Code identify the specific location of the branch within its region. This helps in narrowing down the routing process, making sure that your transactions are directed to the correct branch without errors.

3. The final four digits:

The last four digits of the Sort Code are unique to each branch and serve as the branch identifier. This part of the code is crucial in ensuring that funds are routed accurately, down to the specific branch you are dealing with.

Importance of First Bank Sort Codes

First Bank Sort Codes play a crucial role in ensuring the smooth operation of financial transactions. Here are some key reasons why Sort Codes are essential:

1. Accuracy and Efficiency:

Sort Codes help in accurately routing funds to the intended branch, reducing the chances of errors or delays in transactions. This ensures that your money reaches its destination promptly, whether you are making a transfer or receiving a payment.

2. Security Measures:

By including Sort Codes in every transaction, First Bank maintains a high level of security in electronic fund transfers. The unique identification number associated with each branch adds an extra layer of protection, preventing unauthorized transfers or misrouting of funds.

3. Streamlined Banking Operations:

Sort Codes streamline the banking process by providing a standardized format for identifying branches. This simplifies the transfer of funds between different banks and ensures seamless communication within First Bank’s network of branches.

How to Find a First Bank Sort Code

Locating the Sort Code for a specific First Bank branch is easy and essential for conducting smooth transactions. Here are a few ways to find the Sort Code you need:

1. First Bank Website:

You can visit the official website of First Bank and navigate to the branch locator tool. Enter the details of the branch you are looking for, and the Sort Code should be displayed along with other relevant information.

2. Internet Banking Platform:

If you are an active user of First Bank’s online banking services, you can usually find the Sort Code of your branch in the account information section. Check your account details or contact customer support for assistance.

3. Branch Visit:

If you prefer a more traditional approach, you can visit the nearest First Bank branch in person. Speak to a customer service representative or ask at the branch counter for the Sort Code of your branch.

Common Myths and Misconceptions about First Bank Sort Codes

There are several misconceptions surrounding Sort Codes, so let’s debunk some common myths:

Myth 1: Sort Codes Are Only for International Transactions

Contrary to popular belief, Sort Codes are used for both local and international transactions within First Bank’s network. They are essential for identifying branches and routing funds accurately, regardless of the transaction’s origin.

Myth 2: Sort Codes Are Interchangeable Between Branches

Each First Bank branch has a unique Sort Code that cannot be used interchangeably with other branches. Using the wrong Sort Code can result in failed transactions or funds being directed to the wrong branch.

Myth 3: Sort Codes Are Not Necessary for Online Transactions

Sort Codes are crucial for online transactions within First Bank’s system. They ensure that your funds are routed correctly and prevent potential errors that may occur during electronic transfers.

In conclusion, First Bank Sort Codes are vital components of the bank’s infrastructure, facilitating secure and efficient financial transactions. By understanding how Sort Codes work and why they are essential, you can navigate the world of banking with confidence and peace of mind. Remember to always double-check the Sort Code before initiating any transaction to ensure the smooth transfer of funds. If you have any questions or need assistance regarding First Bank Sort Codes, feel free to reach out to First Bank’s customer support for guidance.

Thank you for taking the time to explore the world of First Bank Sort Codes with us. We hope this guide has provided valuable insights into how Sort Codes operate and why they are crucial for seamless banking experiences.

How do I find my bank sort code Boi?

Frequently Asked Questions

What is a Sort Code and why is it important for First Bank?

A Sort Code is a unique identification number assigned to banks for internal use in processing financial transactions. Each branch of First Bank has a specific Sort Code, which is crucial for ensuring accurate and timely money transfers, direct deposits, and other banking operations.

Where can I find the Sort Code for a specific First Bank branch?

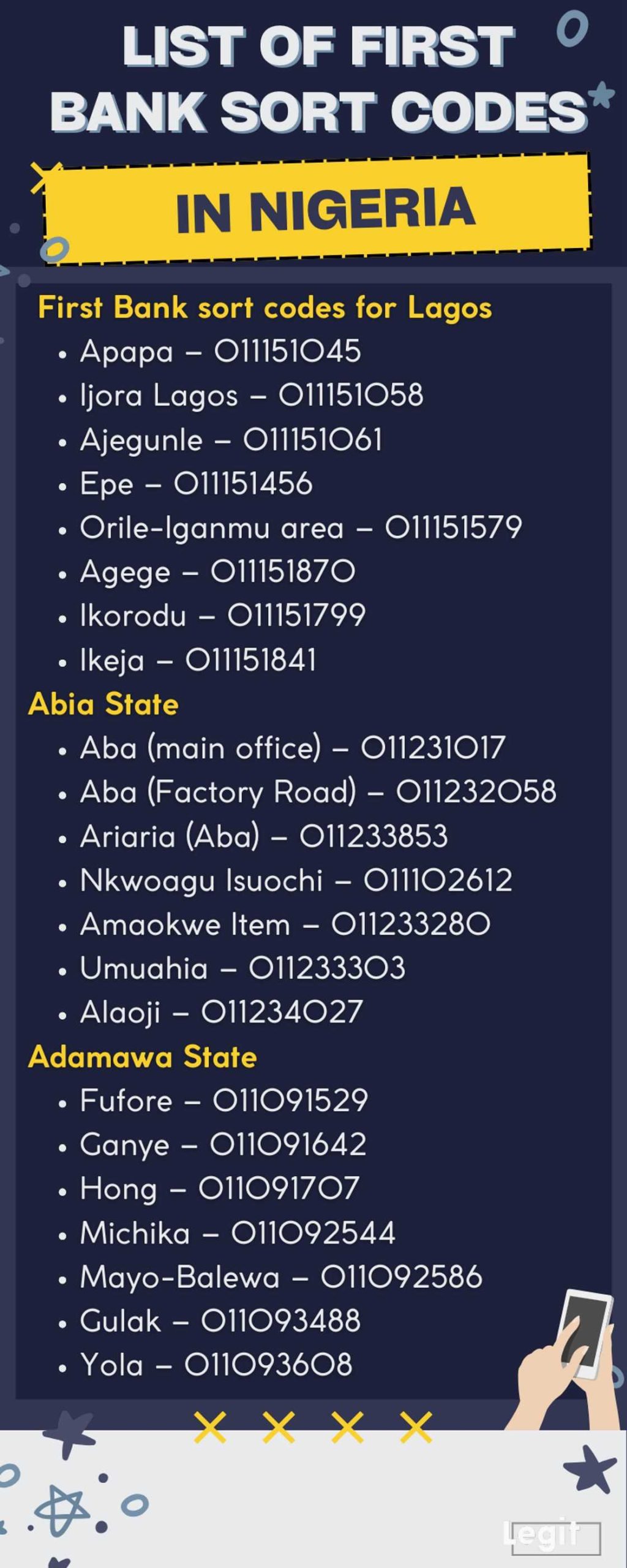

You can find the Sort Code for a specific First Bank branch on your checkbook, account statement, or by contacting the bank directly. Additionally, the Sort Codes for all First Bank branches are available online on the bank’s official website or through a quick internet search.

Do I need the First Bank Sort Code for international transactions?

Yes, you will need the First Bank Sort Code, along with other required banking details, when making or receiving international transactions. Providing the correct Sort Code ensures that the funds are routed to the correct branch and account without any delays or errors.

Final Thoughts

In conclusion, knowing your First Bank sort code is crucial for smooth financial transactions. With the sort code, you can accurately identify your bank branch and facilitate seamless transfers. Always double-check the sort code to avoid any errors that may cause delays or misdirected funds. Stay informed and empowered by keeping your First Bank sort code handy.